Success from applying the modern 3F (FEED-FARM-FOOD) model, the output of pork sold in 2022 increased nearly 2.2 times compared to the same period last year, boosting the livestock revenue up 73%.

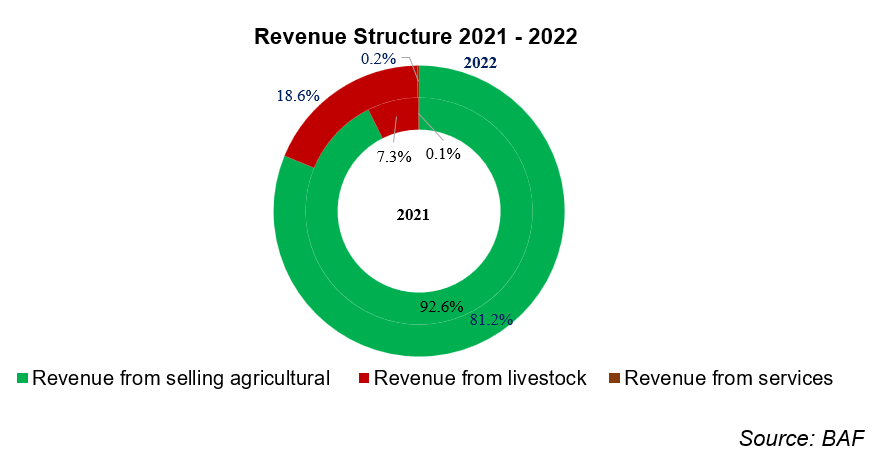

The year 2022 was as a difficult year for the pig farming industry in Vietnam due to the fluctuation of feed prices and the ASF epidemic. However, the application of a modern farming 3F (FEED – FARM – FOOD) model and substantial investment gained positive business results for BAF Vietnam Agricultural Joint Stock Company (BAF, company). BAF recently announced Consolidated Financial report for Q4/2022, showing growth in revenue and sustainable profits from the livestock segment. Total revenue for the year reached VND7,049 billion, mainly from livestock and selling agricultural product. Notably, revenue from livestock reached nearly VND1.317 billion, an increase of 73% over the same period. The revenue structure underwent a strong shift as revenue from livestock increased to almost 19% of the total revenue structure, up from 7% over the same period, demonstrating the company’s transformation into a modern livestock corporation with leading 3F model in Vietnam. The company advocates to reduce revenue from selling agricultural product due to low gross profit margin and many potential risks affected by the war between Russia and Ukraine.

Until now, BAF has developed and operated 23 modern closed farms using European technology, increasing by over 53% compared to the same period, contributing to the promotion of the total herd. In addition, continuously expanding the distribution chain with over 60 Siba Food stores and nearly 300 Meat Shops throughout Vietnam, bringing the quality “Vegetarian Pork” product direct to the consumers. Thanks to this, the output of pigs sold in 2022 reached nearly 336,000, an increase of 2.2 times compared to the same period.

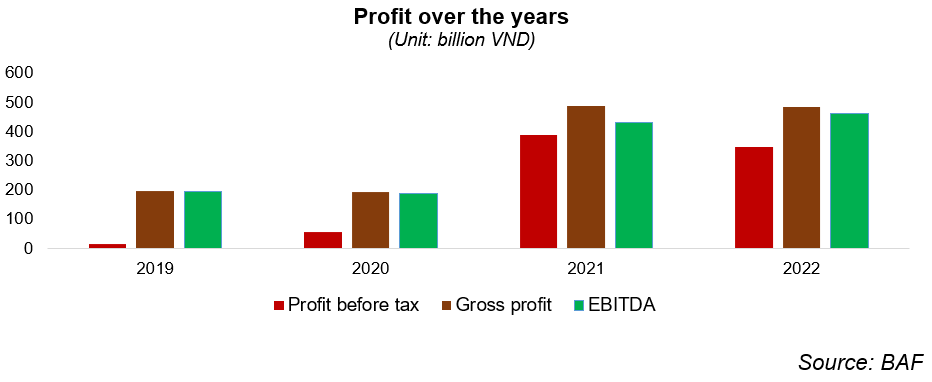

Consolidated Gross Profit (GPM) reached nearly 7% strong growth compared to the level of 4.7% in the same period, GPM from the livestock reached 25%. Compared to the same period, Administrative expenses and Selling expenses recorded an increase during the expansion of farm scale and distribution chain. The pre-tax profit of 2022 reached nearly VND349 billion, net profit margin reached 4% higher than the level of 3.1% in the same period. The EBIT and EBITDA increased slightly to reach 5.4% and 6.6%, respectively, showing efficient operations and good cost control.

As of December 31, 2022, BAF’s total assets recorded a slight decrease of VND4.909 billion, mainly from the collection of receivables. Short-term receivables continued to decline significantly by 46% to VND1.453 billion as BAF has actively collected debts and mobilized resources to develop more modern farms and expand distribution channels. Inventory recorded a 20% decrease of VND875 billion compared to the beginning of the year. Fixed assets recorded an increase of VND1.096 billion, an increase of 103%, as BAF put into operation many modern farms. Short-term and long-term loans recorded an increase of VND976 billion to meet the capital needs for expanding the herd, developing the farm and distribution system. However, BAF’s financial ratios reflect a stable financial health with a current ratio and quick ratio of 1.1 and 0.8 times, respectively.

The price of pork is expected to increase again in 2023.

Last year, the livestock industry faced many challenges due to the rising cost of animal feed and the ASF disease outbreak. In the last months of 2022, the amount of pigs affected by the disease released into the market was quite high, causing the trading price of pork to be around a low level due to concerns of the disease reoccurring.

Under the impact of the disease, the pig supply is expected to be affected by pig deaths and difficulties in re-herb, and the pig prices are expected to recover in 2023. In addition, China’s reopening will drive cross-border commercial activities in the context of pig prices in China being higher than Vietnam by nearly 10%, which will support pig prices in 2023. Furthermore, modern pig farming companies using the 3F model with traceable source and an OIE-recognized safe biological breeding area are seen as the main beneficiaries when exporting is approved.

In the next coming time, BAF will rapidly expand modern farm to increase the herd size to meet the pork growing demand and aiming to export to international markets. Additionally, it will continue to expand the Siba Food and Meat Food chain to bring “Vegetarian Pork” products closer to consumers.