BAF Vietnam Agriculture Joint Stock Company (HoSE: BAF) has just announced a plan to offer up to 6 million bonds in 2022 to raise about 600 billion VND.

BAF Vietnam has just announced the Resolution of the Board of Directors (BoD) on the approval of the following issues: the issuance plan, the plan to use and repay the capital obtained from the public bond offering, as well as the approval of the listing of bonds on the stock trading system.

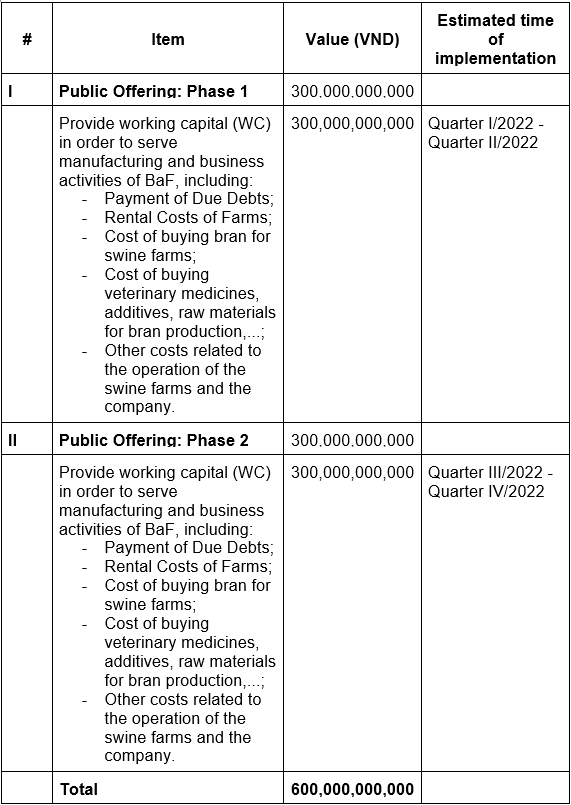

In detail, BAF Vietnam aims to issue 6 million bonds in 2 phases, at the price of VND100,000 per bond, equivalent to the par value of 600 billion VND.

This is a non-convertible bond, without warrants and collateral.

Bonds are offered for sale under the form of bookkeeping, through an issuing agent (An Binh Securities Joint Stock Company, to be more specific) and pay a fixed interest rate of 10.5% per year.

The first phase of the bond offering will take place in the first half of 2022 and the remaining (about 3 million bonds) will be offered in the second half of 2022.

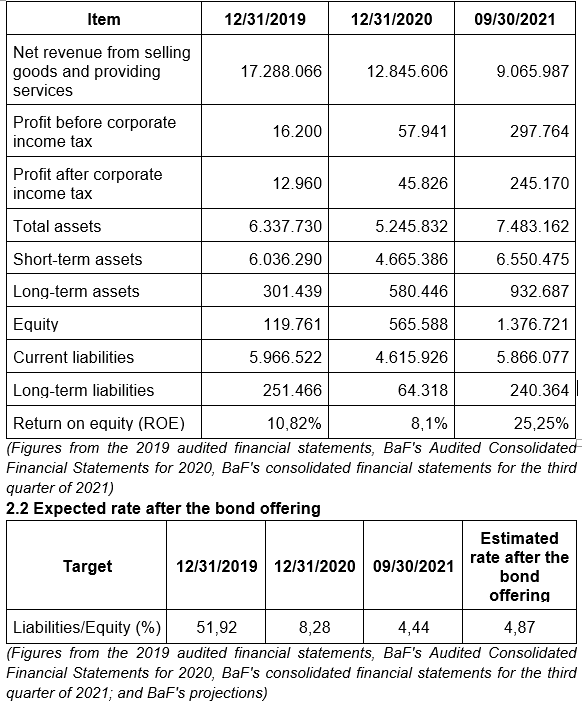

According to the plan, BAF Vietnam aims to achieve total revenue of VND 3,502 billion in 2022 and VND 855.3 billion in profit before tax. By 2025, the above targets are expected to reach VND 25,788 billion and VND 4,455 billion, respectively.

78 million BAF shares have just been listed on HoSE since December 3rd, with a reference price of VND 20,000 per share at the first session.

Soon after, the company received attention from the business community as it show its big ambition in the market in its plan to develop the 3F value chain – from farm to fork.

Phan Ngoc An, Chairman of BAF Vietnam, shared with a reporter from baodautu.vn, said that in order to meet the capital source for the “develop the farm system” plan, this business is forced to increase its capital.

In 2022, BAF Vietnam plans to open and put into operation 5 more farms with an average cost of approximately VND 230 billion per farm (including 2 sow farms, with 5,000 each; 3 market hog farms, with 30,000 each).

Recently, the company has put into operation a feeding factory in Tay Ninh and a factory with a total capacity of approximately 18,000 tons per month in Nghe An to supply livestock factories in the Northern region.

Currently, on average, BAF Vietnam puts on the market about 50,000-60,000 pigs per month and is expected to raise the number to 1.9 million by 2025.

In terms of consumption channel, about 1/10 of the pork this company delivers on the market daily is consumed at the supermarket chain of an affiliated company, 49% owned by BAF Vietnam, which is Siba Food Vietnam Joint Stock Company.

Mr. An stated, based on the plan to develop the herd through the expansion of the farm system, by 2025, Siba Food will operate about 5,000 stores and by 2030, the number of stores will be 13,000.

“Building the 3F value chain in the early stages requires a lot of capital for activities including but not limited to building barns, factories, developing breeding stock, etc. And when everything stays in a stable operation, the costs are mainly related to food supplements. In about 4-5 months, we will announce the official information about the cooperation deal with a strategic partner”, said Chairman of BAF Vietnam.

Hồng Phúc