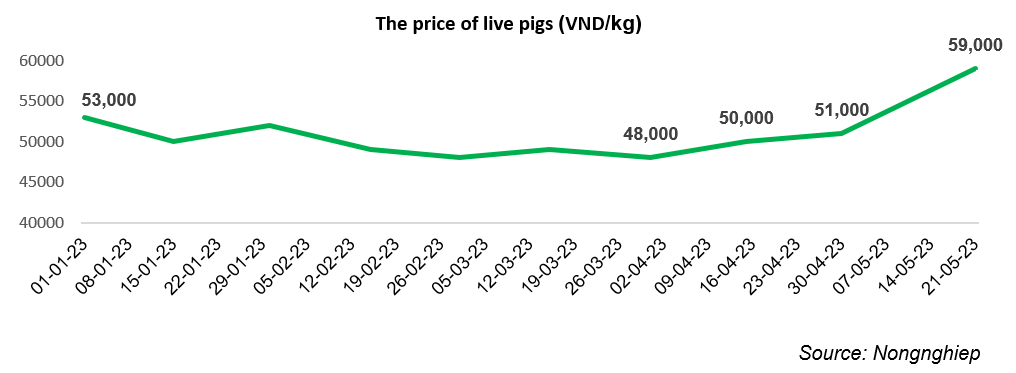

From the beginning of 2023 to mid-April 2023, the price of live pigs recorded a slight decrease from 53,000 VND/kg and bottomed out around the price range below 50,000 VND/kg. After the bottoming phase, the price of live pigs increased by 18% to 59,000 VND/kg on May 21, 2023.

The price of live pigs increased by 18% to 59,000 VND/kg.

The explanation for the price increase is mainly due to the decline in supply as households haven’t restocked due to losses and the impact of African Swine Fever (ASF).

In the early months of the year, live pig prices declined for a long period, and the high cost of animal feed caused many difficulties for households. The production cost of households fell to around 53,000 – 55,000 VND/kg, and they incurred losses of up to 1 million VND per pig sold. Additionally, concerns about the return of ASF and reduced pork consumption in the context of high inflation in the first quarter have made farmers hesitant to restock.

The decrease in supply has created an opportunity for the price of live pigs to increase by 18% in the past month. This is seen as an opportunity for modern pig farming companies which applying the 3F (FEED-FARM-FOOD) model – low production costs to regain growth momentum.

The opportunity for modern 3F pig farming companies

BAF Viet Nam Joint Stock Company (listed on HOSE, stock code BAF) is considered as a representative entity in applying the modern 3F (FEED-FARM-FOOD) pig farming model.

In terms of FEED, the Company has put into operation 3 “Vegetarian” feed factories producing vegetable source livestock feed without any harmful substances to ensure nutrition for pigs. The 3 factories have a capacity of about 460,000 tons/year and have achieved the highest global certifications in Animal feed production quality management systems: GLOBAL GAP CFM 3.0 and FSSC 22000 Ver 5.1.

In terms of FARM, a series of farms have been put into operation, and construction has begun to increase the number of farms operating and deployed to 23 farms. BAF’s closed farm system applies modern European technology, an automatic feeding system through a central control system to minimize contact between humans and animals, limit diseases, significantly reduce labor costs, and achieve a water circulation rate of 95%.

In the FOOD sector, BAF Vietnam has successfully launched high-quality BAF Meat, a plant-based protein product made from vegetarian feed. They have continuously expanded their distribution network, with over 60 Siba Food stores and more than 300 Meat Shops spread across Vietnam

The substantial investment and support from the International Finance Corporation (IFC) have contributed to the rapid development of BAF. Currently, BAF has emerged as one of the top 5 largest pig farming enterprises in the country. The total number of pigs sold in 2022 exceeded 303,500, nearly doubling compared to the same period. At present, BAF’s total herd size is around 230,000 pigs, with a production cost of approximately 45,000 VND/kg.

BAF aims to continue expanding its modern farm system and plans to operate an additional 9 farms by the end of 2024. The projected total herd size will reach 90,000 sows and 2.2 million commercial pigs.

Dabaco Group (listed on HOSE, stock code DBC) is a longstanding diversified company in the livestock industry. Its main business areas include pig farming, poultry farming, and real estate development.

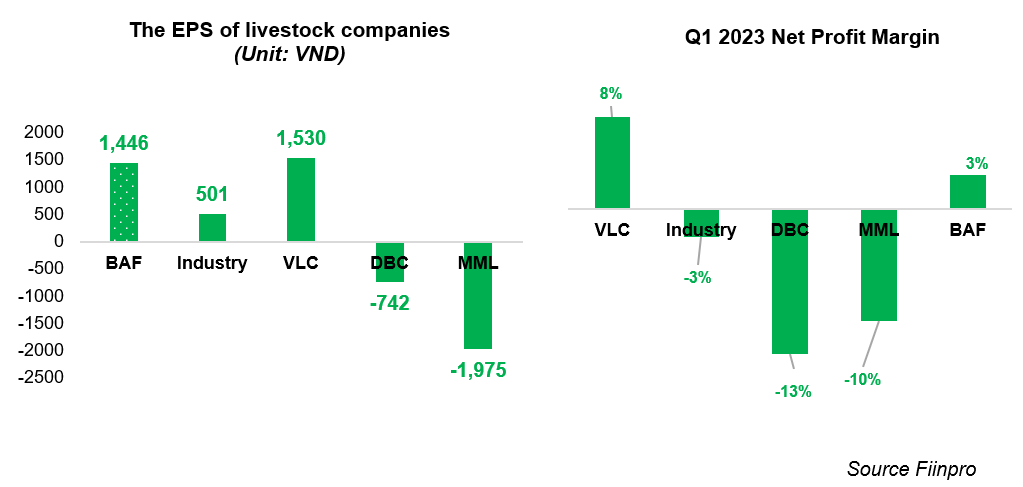

In the first quarter, DBC recorded net revenue of 2,314 billion VND, a decrease of 18% compared to the same period. Due to business operations below the cost price, DBC incurred a net loss of 321 billion VND, while it made a profit of 8.6 billion VND in the same period last year. This is also the largest quarterly loss for Dabaco to date.

As of mid-April 2023, DBC’s total pig herd reached 120,000, a 25% decrease compared to the same period (according to VCBS). According to Mr. Nguyen Nhu So, Chairman of Dabaco, the production cost for the pig farming segment of DBC is currently around 55,000 – 56,000 VND/kg.

The price of live pigs is expected to continue increasing due to limited supply and the impact of ASF

Currently, the market share of households livestock farming in Dong Nai province has decreased sharply to around 25%-30%, compared to the previous 70%. The number of households in Vietnam has reduced by nearly five times, with less than 2 million households in the past 10 years.

According to Mr. Truong Sy Ba, Chairman of BAF, under the recent outbreak of ASF, Vietnam’s total pig herd has decreased by 20-25%. Additionally, the low of live pig’s price has led to a massive selling-off by farmers and a limitation in restocking. Under the impact of the disease, it is forecasted that from the end of May to the end of the second quarter of the following year, the average price of live pigs will range from 60,000 to 65,000 VND/kg.

According to the forecast by OECD, Vietnam will rank second in Asia (after China) in pork consumption, with an annual growth rate of 3.1% in the 2022-2030 period. Fitch Solution also predicts that Vietnam’s pork consumption growth rate during the 2018-2026 period will increase by 25%, and by 2026, the average pork consumption in Vietnam will be 31kg per person.

The limited supply of pigs in the upcoming period, along with the recovery of total demand, will be the main catalyst for pushing up the price of live pigs. It promises to create favorable conditions for modern livestock enterprises to return to a growth trajectory.