International Finance Corporation (IFC) is expected to invest VND 600 billion in BAF Vietnam Agriculture Joint Stock Company (BAF, Company) through convertible bonds. Expanding modern livestock farming under the closed 3F model, raising the herd size to nearly 1.5 million with a production output of nearly 4 million sows and pigs by 2025.

According to BAF’s proposal to collect shareholders’ written opinions dated July 27, 2022, BAF submitted to the General Meeting of Shareholders the offering plan, plan on the use of proceeds from the convertible bond private placement of VND 600 billion for IFC.

IFC – a member of the World Bank (World Bank) is one of the global financial institutions that operate toward Sustainable Development focusing on developing economies by investing in Private Enterprises. With the mission to promote economic development by encouraging the development of Private Enterprises, IFC has invested more than USD 321 billion over the past 60 years. IFC has invested in the Vietnam market for nearly 10 years including the investment in Techcombank, Masan, GEC, etc.

To support the regional pork industry in Asia to overcome the consequences of African swine fever (ASF) as well as to secure the demand for clean and safe food, IFC aims to invest in livestock modern farming enterprises that apply the 3F model (FEED-FARM-FOOD) in Vietnam, of which BAF has been a typical company. Up to now, BAF has completed the 3F chain by owning 2 feed mills – 260,000 tons/year; 16 modern farms with a total herd of up to 200,000 heads; and a food distribution system of more than 50 stores and 250 Meat Shop counters.

The investment will be made in form of convertible bonds, without warrants and without collateral. The total number of bonds offered is 600 bonds (with a par value of VND 1 billion), a term of 84 months. The coupon rate is competitive at around 5.25%/year to 5.5%/year. This is considered a very competitive interest rate for bonds without collateral. The Proceeds collected from the offering will be used for expanding the farm, raising the herd size to nearly 1.5 million pigs aiming toward a production output of nearly 4 million sows and pigs by 2025.

Additionally, IFC will potentially support BAF in enhancing Corporate Governance (CG) towards implementing best corporate governance practices to increase transparency and ensure shareholders’ interests. Integrating sustainable development indicators such as GRI standards into the development strategy of the Company, evaluating E&S (social environment) of farming operation towards sustainable development. This will enhance BAF’s image and create opportunities for attracting competitive offshore funding in the future.

Revenue from livestock has increased nearly tripled in the first 6 months of 2022

BAF has just released its Consolidated Financial Statements for 2Q of 2022 with sustainable growth in Revenue and Profit from the livestock segment. Output and revenue from livestock production have continuously increased in recent times.

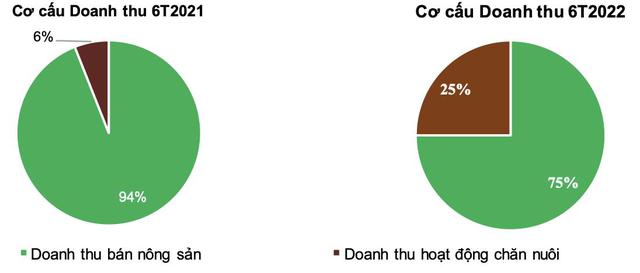

Consolidated net revenue in the first 6 months reached VND 3,164 billion, coming mainly from livestock and agricultural trading. The sharp increase in sales of pigs in Q2 2022 has boosted the revenue from livestock to reach over VND 800 billion, rising 2.4 times compared to the same period last year. Revenue structure had positive movement when the revenue from livestock accounted for 25% of total revenue, much higher than the level of 6% in the same period last year, this has shown a shift in the strategy of the company to become a leading modern livestock company operated under 3F model in Vietnam.

The reduction in weight from the agriculture segment has boosted the growth of Gross Profit Margin to 7%, which rose sharply from 5% in the same period last year. General and administrative expenses and Selling expenses recorded an increasing trend compared to first haft last year, this is to spend for the development of modern pig farms and the expansion of Siba Food stores and Meat Shop counters. Profit before tax and profit after tax in the first 6 months of the year recorded VND 155 billion and VND 128 billion, respectively. Net profit margin reached 4%, higher than 3% last year. EBIT and EBITDA margins increased slightly to 5% and 6% respectively, showing efficient operation and good control of operating costs.

As of June 30, 2022, BAF’s total assets recorded VND 4,856 billion which decreased 11% compared to the beginning of the period mainly due to the completed receivables collection. Short-term receivables dropped sharply by 45% to only VND1,582 billion when BAF actively collected debts to invest and expand their farming system. Inventories reached VND 1,449 billion, which rose 33% compared to the beginning of the year, the sows and pork raising currently will be sold to the market in the coming months with expected increasing prices due to supply shortages in recent months. Fixed assets recorded VND 733 billion, up 35% when BAF put into operation many modern farms last year. Short-term and long-term loans increased to VND 420 billion, a slight increase compared to the beginning of the period to meet the increase in herd size and to invest in equipment and modern barns. Even with the above, BAF’s financial ratios show good financial health with the current ratio and quick ratio being 1.13 and 0.6 times respectively. The deb/equity ratio is good at 0.27 times.

The impact of ASF has severely affected the total supply of pork, the purchase price of live pigs continued to increase by 21% from the beginning of 3Q of 2022. The purchase price of live hogs is fluctuating strongly at around VND69,000/kg and is expected to remain high until the end of the year. This will greatly contribute to BAF’s revenue and profit in the last months of the year. Besides, the timely access to the fund from IFC will help BAF to expand its development and to increase the total herd to ensure the strategy of becoming Top 3 livestock companies in Vietnam.